Workplace Retirement Savings Plans: What Should You Do If You Quit, Are Laid Off or Fired?

by Gabriel Lewit

If you leave an employer before reaching retirement age, should you (or can you) take your retirement accounts/benefits with you? That’s a question with major consequences. Your options depend on the type of plan you are in. There are two basic plan categories: defined benefit and defined contribution.

“Defined Benefit” Plan

A defined benefit plan defines your retirement income based on your salary, years of service, etc. Those are unusual outside of government service and a few major corporations. If your retirement benefits are tied to these plans, most likely you must leave them behind until retirement age. For that reason, it is vital that you update the plan administrator if you have important changes (address, marital status, etc.) and keep track of your former employer’s benefits department contact information.

“Defined Contribution” Plan

A defined contribution plan has no preset benefits; you only get back what you put in (i.e. pre-tax contributions), matching funds from your employer (which they may or may not offer), plus investment growth. If you are in this type (such as a 401(k)), in most cases you will have three options, each with its own tax consequences.

Option 1: A Lump Sum

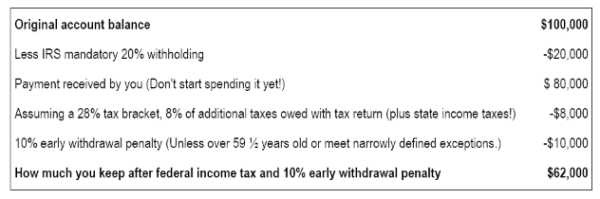

You can opt to withdraw your benefits as a single payment, cashing out the account. This is seldom advisable. If you select a lump sum payment but do not immediately deposit the money into another qualified retirement account, you will owe income taxes and a 10% penalty if you’re under 59 1/2. And to process your request, the plan administrator is typically required to withhold and send 20% to the IRS. Here’s the money math for a lump sum withdrawal of $100,000:

You read that correctly; you could lose $38,000 by taking a lump sum distribution!

If you choose, you can take receipt of the money then deposit it into a new retirement plan (called a Rollover) within 60 days but HEED THIS WARNING!

If you miss that 60-day deadline, even by one day, you will owe taxes on the entire sum! Additionally, if you take physical receipt of the money, even for a short time, your employer is generally required to withhold/send 20% to the IRS.

You’ll postpone taxation and avoid the early withdrawal penalty with Option 2, below.

Option 2: Direct Transfer to Another Retirement Plan

To preserve the tax advantages of retirement funds, you must roll the balance into another qualified plan. This is called a direct rollover. Your choices are either (1) an Individual Retirement Account (IRA) or (b) your new employer’s plan (if they accept such transfers).

Workplace retirement plans vary widely. Thoroughly inspect your new employer’s plan options (or have us do it for you) before deciding. Depositing the funds into an Individual Retirement Account may allow greater flexibility and control of funds. Here two tips on transferring to another qualified plan.

- To avoid unnecessary taxes, arrange a direct rollover from one plan to the other. Never personally take receipt of the money. This will eliminate IRS requirement to withhold 20% and reduce chances of making a mistake.

- If you roll your funds directly into a traditional IRA, you may have an option to convert it to a Roth IRA. You’d owe income taxes now but not upon withdrawal and never on the interest accumulated all the years till retirement. (For some, that’s a better option; we can perform that calculation.)

Option 3: Stay Put

A third option is that you can do absolutely nothing about your money in a former employer’s plan and just leave it there. There are no immediate tax consequences. And it still preserves your rights to Options 1 and 2 above. But keeping it there long term may not be in your best interest. How solid is your past employer? How professionally managed is their plan? What are the investment options?

Staying put for the short term buys you time to explore more thoroughly. And investigate you should! Likely, you will be better served transferring the money into another qualified plan, but which one? (We can help).

Food for Thought

While the event may be unfortunate that brought you to the point of deciding what to do with your retirement funds at a past employer, you are among the lucky few who had money invested in a workplace retirement plan. According to the U.S. Bureau of Labor Statistics, in 2019 only 23% of private sector employees participated in a workplace retirement plan when it was offered and they were eligible.

That wraps back to the title of this article – “Workplace Retirement Savings Plans: What Should You Do If You Quit, Are Laid Off or Fired?” Decisions about a large sum of money can be intimidating. Most people have neither the knowledge nor the time to manage a retirement portfolio. I outlined your three options but those are fraught with minefields of IRS regulation. And they can sometimes require a high degree of taxation and investment knowledge.

To determine the most advantageous use of your retirement funds, it vital to only work with an advisor who is a fiduciary. (A fiduciary is legally bound to put your interests first). Not all financial advisors are fiduciaries. But all advisors at SGL Financial are.

If you are looking for a plan guided by experience and knowledge you trust, then call (847) 499-3330 or click here to set up a 15-minute initial telephone assessment. It is a complimentary service without obligation and includes our “Comprehensive & Holistic Retirement Planning” guide.