4 Strategies to Maximize the Tax Efficiency of Your Investment Plan

by Gabriel Lewit

With this year’s tax deadline around the corner, you may be reviewing your taxes now and identifying opportunities to lower your bill next year. One opportunity to improve tax efficiency is by carefully reviewing your investment plan with an investment advisor.

A careful review of your investment activity for 2020 could reveal possible steps to take in 2021 to minimize your tax obligations come April 15, 2022.

1) Understand Income vs. Long-Term Capital Gains

The first step toward understanding your tax burden is knowing whether your investments will incur ordinary income rates or long-term capital gains rates.

- Ordinary income rates – apply to any sold assets held for less than one year, as well as some types of dividends that are classified as non-qualified dividends (for example, most payments from Real Estate Investment Trusts)

- Long-term capital gains rates – apply to assets held for at least one year before sale, as well as qualified dividends

- 0%, 15%, or 20% depending on income bracket and filing status

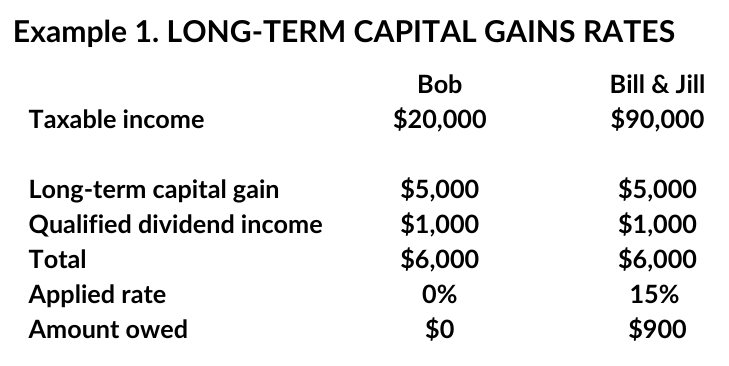

Let’s look at two hypothetical situations. Bill and Jill are married and file jointly. Bob, their son, files as a single taxpayer. Both filers earned $5,000 in long-term capital gains and $1,000 in qualified dividend income, or $6,000 total. Because Bob’s taxable income is $20,000 for the year, this $6,000 is taxed at 0%. However, his parents have $90,000 in taxable income. They pay 15%, or $900.

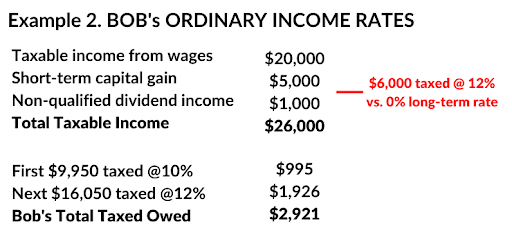

To understand the impact of ordinary rates when they are applied to investments, let’s return to Bob in our earlier example. Let’s assume Bob earned $5,000 in short-term capital gains and $1,000 in non-qualified dividend income. This $6,000 is then added to Bob’s $20,000 in taxable income, the sum of which is taxed at ordinary rates.

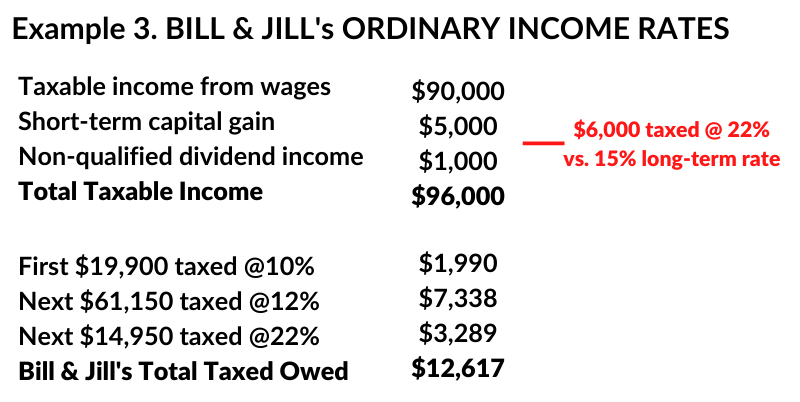

Bob’s parents are no better off. Their $6,000 in combined short-term capital gains and non-qualified dividend income raises their $90,000 in taxable income to $96,000. Because they fall within the 22% marginal tax bracket, they’ll pay 22% on this investment income versus 15% if long-term capital gains rates were to apply. In total, they would owe $12,617 in taxes.

It goes without saying: if possible, hold assets for at least one year before selling to obtain preferential long-term capital gains rates. And when it comes to dividend income, the yield from non-qualified dividends must be high enough to outweigh the additional tax burden.

2) Offset Gains with Losses

While investment gains raise your tax burden, the opposite is also true. Realized losses—unfortunate though they may be—can lower your tax burden.

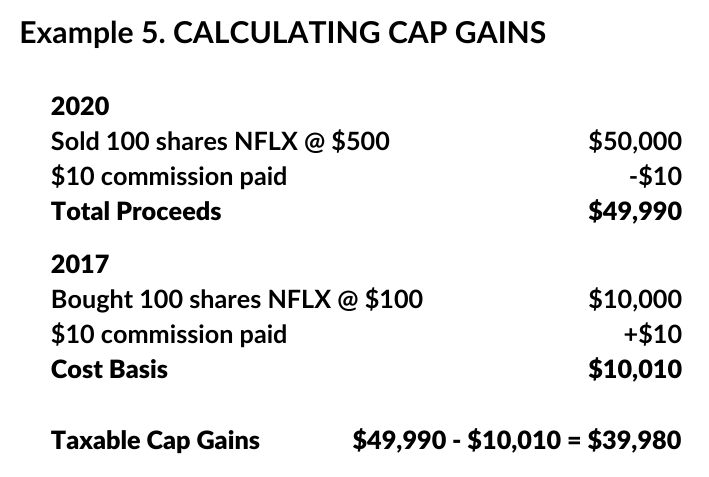

Calculating your capital gains and losses—whether short-term or long-term—requires knowing a few details about both ends of the investment transaction, namely the acquisition price, the sales price, along with any commissions and other fees paid.

In the example below, a hypothetical investor was fortunate to buy 100 shares of Netflix in 2017, when the online streaming company traded for about $100 per share. This investor paid a $10 commission to their broker, for a total cost basis of $10,010.

Three years later, the investor sold the position at $500 per share, paying $10 in commission and generating $49,990 in net proceeds. The capital gain is obtained by subtracting the cost basis from net proceeds i.e. the investor will owe taxes on $39,980 in capital gains. Because the investor held Netflix for more than one year, lower long-term capital gains rates will apply.

Capital losses are calculated in the same manner. Subtract cost basis from net proceeds to find the capital loss that can then be used to offset your taxable income.

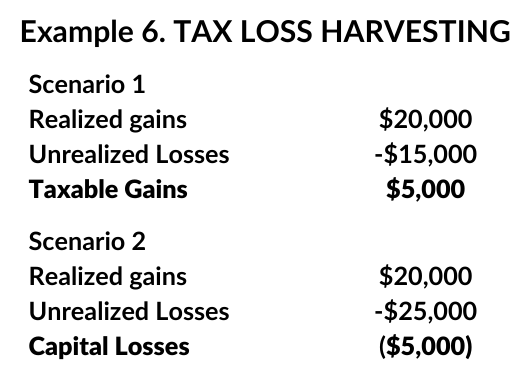

This process is called tax loss harvesting, and it involves using investment losses to offset investment gains or reduce taxable income.

In Scenario 1, the investor has $20,000 in realized gains for which they will owe taxes. By booking the $15,000 in unrealized losses in their portfolio, this tax burden can be minimized to $5,000.

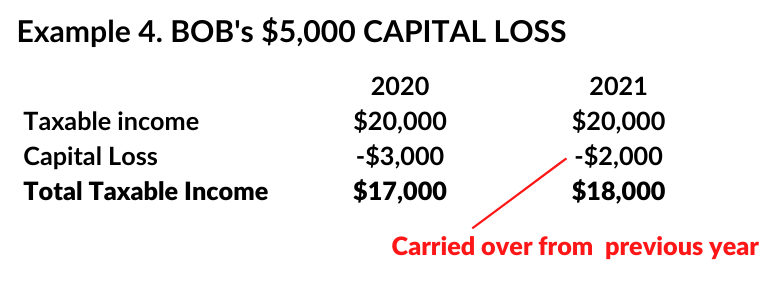

In Scenario 2, booking the unrealized losses would generate $5,000 in capital losses. Of this, $3,000 can be deducted from the taxpayer’s taxable income, with the remainder carried over into the following tax year.

3) Avoid Wash Sales

Investors taking advantage of tax-loss harvesting should be careful not to run afoul of the wash-sale rule. This rule is designed to prevent investors from booking losses before the last trading day of the year—for the purpose of minimizing taxes—and then immediately re-establishing an identical position.

For example, assume an investor sells a losing position in SPY, an ETF that tracks the S&P 500 Index, on December 31. Under the wash-sale rule, the investor would be prevented from buying an equal position in SPY in the 30 days before or after December 31. If the rule is violated, the trading loss cannot be used to minimize the investor’s tax burden.

In addition, the wash-sale rule prevents investors from purchasing a substantially similar security in the 30 days before and after the tax-loss trade is incurred. For example, the IRS would not look kindly on an investor buying VOO, a competing ETF that also tracks the S&P 500 Index, in an attempt to skirt the wash-sale rule.

In short, an investor taking advantage of tax-loss harvesting is presented with an interesting problem: what to do with the proceeds? Knowing the wash-sale rule will help the investor to make an informed decision on when and where to deploy this capital.

4) Reinvest Dividends

Of course, the easiest way to limit headaches regarding ordinary income tax rates, long-term capital gains rates, capital losses, tax-loss harvesting, and the wash-sale rule is to invest inside a tax-advantaged account, such as a traditional IRA or Roth IRA.

With a traditional IRA, investors contribute using pre-tax income. For 2020, an investor can contribute $6,000 to a traditional IRA account ($7,000 if 50 or older) and deduct an identical amount from their taxable income, assuming your income doesn’t exceed certain levels. Your investment grows tax-free year after year. Withdrawals are taxed at ordinary income rates when you reach retirement age, when presumably your income is lower than your working years.

Investors contribute to a Roth IRA using after-tax income. While there is no upfront tax benefit, withdrawals are tax-free. This means your investments grow tax-free without the need to worry about reporting capital gains taxes or engaging in time-consuming strategies to minimize your tax burden.

The IRA is also useful for holding certain types of dividend-producing investments (e.g. high-yielding REITs) that would otherwise be subject to higher ordinary income tax rates if held within a taxable brokerage account.

SGL Financial and Your Investment Plan

No investor wants to see their hard-earned investment gains eroded by unanticipated tax obligations. Fortunately, there are steps you can take this year to help minimize the burden. Investing the time now to review your situation with an investment advisor could reap rewards in the long run.

At SGL Financial, we believe in applying evidence-based, modern, theory-driven portfolio management with an active overlay. We strive to keep investment costs low, minimize turnover and taxes, and – of course – maximize returns.

Our firm is a holistic, advisory business, meaning our team members are well-versed not only in investing but also in the many facets of financial planning that should inform your investment plan. We offer fee-transparent, personalized services that take a holistic approach to our clients’ financial futures.

Moreover, we have CPAs on staff who inform our investment approach, so that we can effectively coordinate our clients’ investment plans with their tax strategies. To learn more about how SGL Financial can serve you, reach out today