7 Retirement Issues That Should Be On Your Radar

by Steve Lewit

Whether you’re already retired, thinking about retiring or retirement is just on your mind, there are specific financial concerns which, if not considered, could undermine the best years of your life.

Most folks don’t understand the stress that retirement puts on finances.

You work all your life to save, grow and accumulate retirement funds and then the day comes when your paycheck is no more, and your retirement funds must provide enough income to support you for the rest of your life.

And, by the way, the rest of your life could be another 25 to 35 years.

Here’s my top 7 list of retirement issues that I believe you need to think about and plan for.

1. The Retirement Risk Zone

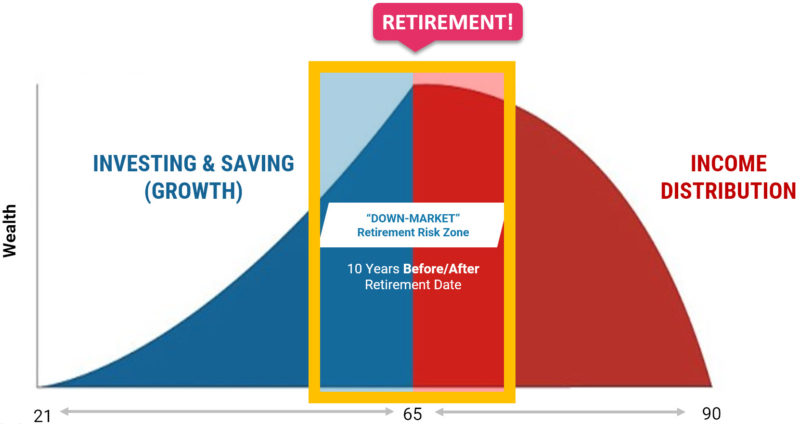

What happens to your investments the 10 years before and after retirement, what I call the Retirement Risk Zone, will have a major impact on whether your money will last you through your lifetime or if you might run out of money along the way.

Big losses during these years, called Sequence of Return Risk, will accelerate the depletion of assets during retirement, upping the probability that your money will not last as long as you do. We are at the end of the longest bull market in history now and the likelihood of a market downturn is quite high. Do you need so de-risk your portfolio? Reallocate? Better diversify?

Now, especially if you’re in the Retirement Risk Zone, is the time to consider how to protect you downside losses.

2. The National Debt and Your Taxes

When the government borrows money, called the National Debt, it must pay interest on what it borrows. In September 2018 the Congressional Budget Office reported that fiscal 2018, net interest on the public debt rose by $62 billion to about $371 billion, a soaring 20 percent jump.

Interest costs are the fastest-growing part of the federal budget. Over the next decade, interest costs will total nearly $7 trillion, rising to become the third-largest ‘program’ in the federal budget.

Deficits don’t usually rise in economic booms. Right now, the U.S economy is cranking on all cylinders. That should mean higher tax revenues and smaller deficits. Fiscal 2018 spending exploded by nearly 130 percent, but federal tax receipts rose just 0.4 percent.

Where will the government find the funds to pay the rising interest costs and the rising costs of all other government programs? That’s right. Out of your pocket by raising taxes is the most logical answer.

Are you making the right decisions now so that you are not paying huge taxes in the years to come? Take a look!

3. Social Security – Broke and Broken

We’ve seen this movie over and over again, but there is no fix in sight. There isn’t even a serious discussion or reform on the table.

Right now, it is estimated by the Social Security Administration calculates that the program can pay all promised benefits until the year 2037. Then, its reserves will be exhausted, and ongoing Social Security payroll taxes will cover only 78 percent of benefits.

Add to that that the cost of living increases you receive are often absorbed by an increase in Medicare costs, the future of counting on Social Security as it is today is questionable.

When and how you take Social Security, and how you plan Social Security require careful consideration.

Taking benefits as soon as possible, for example, at age 62 locks in payments that are only 75 percent of what they would be at age 66, which is defined as the full retirement age for the current wave of retirees. Delaying benefits at age 66 will raise them by 8 percent a year until age 70, after which benefits do not increase with age.

Keep an eye on this issue and plan wisely.

4. Inflation – There’s Always More to Come

Core inflation rates have been running below historical averages and within the Fed’s target rate. However, if the recovery gathers any steam—and we’d all better hope it does—we can expect inflation to become more than the specter it’s been in past years.

Many folks underestimate, or don’t estimate at all, the impact of inflation. For example, if you’re living on $50,000 per year today, and inflation were 3%, you would need $67,196 annually to maintain your lifestyle.

If you are receiving fixed income through a pension or annuity which doesn’t have a Cost of Living Adjustment (COLA), the buying power for that stream of income is eroding every day. So too with your investments.

If you measure the growth of your investments in market dollars, let’s say 5% per year, that might sound pretty good. But if you measure them in real dollars, adjusting for inflation, the real growth would be 2% (assuming a 3% inflation rate), which, considering the risk you may be taking, may not sound very good at all.

Rising prices kind of sneak up on you. So, be careful and always take inflation into consideration.

5. Medicare – Cuts May Come

As we age we are more prone to medical issues, a fact of life. Understanding the challenges of rising healthcare costs and how Medicare may be affected in the future is critical to formulating a sound retirement plan.

Medicare costs will be under relentless pressure from the demands of the aging Baby Boomer population, a growing shortage of physicians, and general inflation.

Proposals to cut federal deficits must include Medicare to be credible. This is a political nightmare and neither party wants to really take the problem on.

Look for some legislation that will have you paying more out of your pocket, especially if you are of higher wealth. With the national debt and the interest on the national debt getting out of hand, at some point Medicare will come under the microscope and reductions will have to be made.

6. Long-Term Nursing Care – Myth or Reality?

You’ve heard this before and, if you’re like most Americans, you want to put your head in the sand and make believe it will never happen to you.

The problem is, statistically, one in three women will live past 90, and one in five men will do the same.

There is a 70% chance you’ll find yourself needing home healthcare or the services of an assisted living community. The costs for these services are skyrocketing, anywhere from $75,000 – $125,000 annually in a facility and half that at home.

Where will these funds come from?

As much as you don’t want to face this music, the odds are stacked against you and the costs could undermine your entire retirement or what’s left of it. Keep this cost on your radar.

More important, take some action to understand it better and create a plan that will help you if you are unfortunate enough to need these services.

7. Advice – Who and What to Trust

Everyone has an advisor, either a professional advises you, or you advise yourself. To succeed, you must get trusted information and trusted advice.

Unfortunately, there is a lot of hype in the marketplace and it is difficult to know who is giving you accurate information and helping you make decisions that are in your best interests. If you are going to work with a professional make sure to work with someone who is Holistic Fiduciary.

This is a person who is legally bound to make recommendations that are in your best interests, and who will consider using investment and insurance products, whichever works best in your plan.

If you are using a broker or insurance agent, that person is not a Fiduciary. Most other Fiduciaries are biased towards keeping your money in the market and won’t consider using insurance products. Get clear on who you are working with and what his or her biases are.

If you are your own advisor, lean towards making decisions based on independent research rather than reading newsletters, blogs, or listening to the so-called financial gurus on TV and radio.

Getting retirement right is a one-shot deal. If you make a mistake when you are in the Retirement Risk Zone, it will difficult if not impossible to correct.

Retirement is that time where you are supposed to kick-back and do the things you enjoy. It is a time where you are supposed to have confidence and peace of mind about your financial future.

But, the future is always unknown. And, to make things more problematic, we live in politically and economically tenuous times. The market is volatile, politics are contentious, the world economy is lagging. Stay tuned and stay aware. Act only on good, solid, well-researched advice.

Keep these 7 issues on your radar to be one of those people who lived “happily ever-after”.