Average Return or Consistent Returns: Which Is Better for Retirement Planning?

by Gabriel Lewit

In this limited space, it would not be possible to convey all you need to know about retirement planning. But I can show you a new way to look at retirement saving, income and return on investments.

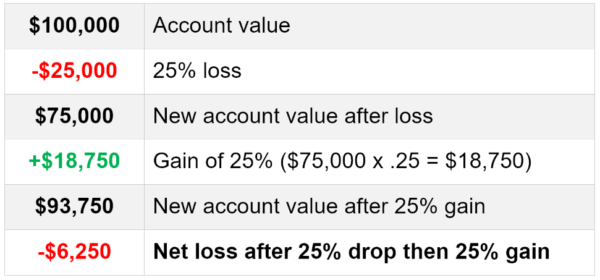

To get us going, here’s a money-math question. If your portfolio lost 25% in a down market, what percentage must it gain to recoup that loss? The obvious answer is 25% but is that correct? Nope!

As you can see in the below chart, the 25% increase is applied to a smaller after-loss balance so can never result in in a gain equal to the loss. How much would you have to earn to restore your original balance? 33.33% just to break even! ($75,000 x 33.33% = $25,000).

Market volatility can kill your balance (and fray your nerves too!) It will always take a larger gain to offset a loss.

So, which is better: average return or consistent returns? That depends. Are you in the saving phase or income-withdrawing phase of retirement planning? And how well do you handle financial stress?

Average Return

Average return is just what you’d expect; add up the figures, divide by how many numbers to get the average of them. You’d think if your average return were high, you’d be better off. But is that so?

Yes and no. Let’s look at hypothetical portfolios A, B, C, D.

Yes, a high rate of return is good but it also comes with greatly increased risk. And, as I showed above, downward swings in your returns may wipe out a later uptrend.

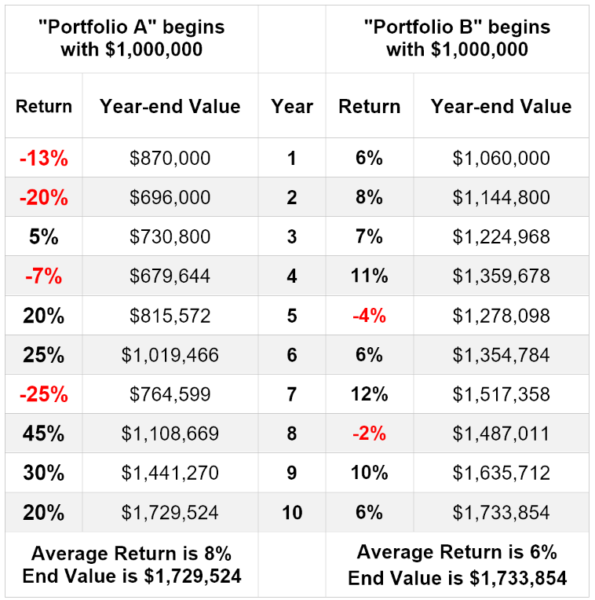

Check out the table below for Portfolio A and B, both starting with $1 million.

Despite having a higher average return in A, the account value is nearly the same. Full disclosure compels me to say, if withdrawals are taken and/or the interest crediting of Portfolio A were jumbled into a different order (sequence of returns), the outcome would be different—maybe higher although lower is also a distinct possibility.

But one thing you can bank on is higher returns cause a higher risk that all gains and even original investment could be wiped out. (Can you imagine living with the of market volatility of Portfolio A!?! I can say with certainty, the owner of Portfolio B would sleep much better at night.)

Average return IS important but not the be-all, end-all of investment decisions.

Consistent Returns

Consistent returns smooth out market fluctuations. Not only is that far better for your nerves, but it could be better for your account balance too. That is especially true when you begin using your savings for their intended purpose–retirement income.

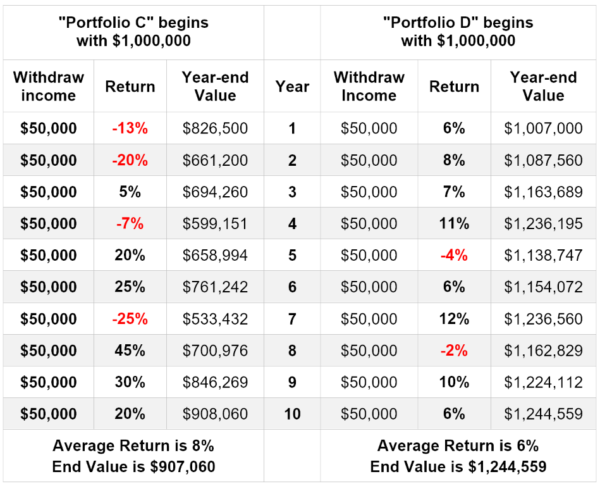

Check out this side-by-side comparison of the exact same interest crediting as in the chart above. The portfolios begin with the same $1,000,000 balance except $50,000 of income is withdrawn each year.

Portfolio C was credited with gains as high as 45% which boosts the average return. But as money is withdrawn, there are less funds on which to earn gains. Full recovery from losses is nearly impossible.

On the other hand, Portfolio D experienced only modest gains—a high of 11%. A few minor losses too, but it doesn’t take as much to make up for those.

Despite having an average return of just 6%, it has a much higher end value. And the owner of Portfolio D never felt the need to hit the panic button because of wild market fluctuations.

That brings us back to the question posed above, “Average return or consistent returns: which are better for retirement planning?” The answer depends on where you are in the retirement planning journey. Young people with a lifetime of earning ahead of them and years to recover losses may boldly invest their savings and calmly weather market volatility.

But likely that doesn’t describe you who are reading this. If you are typical, as your retirement date looms in the foreseeable future, you feel more comfortable with a more conservative approach to investing. And as I’ve illustrated here, you are not really missing out (except on headaches and sleepless nights).

“The Rule of 100” is a useful formula. Subtract your age from 100. The remainder is the percentage you could invest in the stock market (although not wild-ride speculative funds.) The balance should be in safe-money, principal-protected products. That’s a rule of thumb, not a hard fast rule. Your portfolio should be adjusted to match your changing personal risk tolerance.

The economic dance of planning your retirement can become a complicated performance with many steps to choreograph. Here are the key moves:

- Consistent returns over the long haul.

- Sensible market risk for your investment timeline.

- Diversification among asset classes

- Regularly rebalancing your portfolio.

- And this is VITAL: only work with an advisor who is a fiduciary! (A fiduciary is legally bound to put your interests first).

Heads up: not all financial advisors are fiduciaries. But all advisors at SGL Financial are.

If you are looking for a plan guided by experience and knowledge you trust, then call (847) 499-3330 for a 15-minute initial telephone assessment. It is a complimentary service without obligation and includes our “Comprehensive & Holistic Retirement Planning” guide.