When Will I Need a Parachute?

by Steve Lewit

What goes up, must come down. But, when and how hard or soft will I land? When it comes to investing, I believe everyone will need a parachute sooner or later. Especially now!

The Lurking Question

As this bull market officially surpasses the length of all other bull markets in history, one must wonder when it’s going to end. I certainly do. Especially since, seemingly, every time I check my investment accounts the values keep going up. But, in the back of my mind is that lurking question, “when will the bubble gum machine run out of bubble gum?” Not that I chew bubble gum. But, you get the idea, right?

Bull Markets End Quickly and Deeply

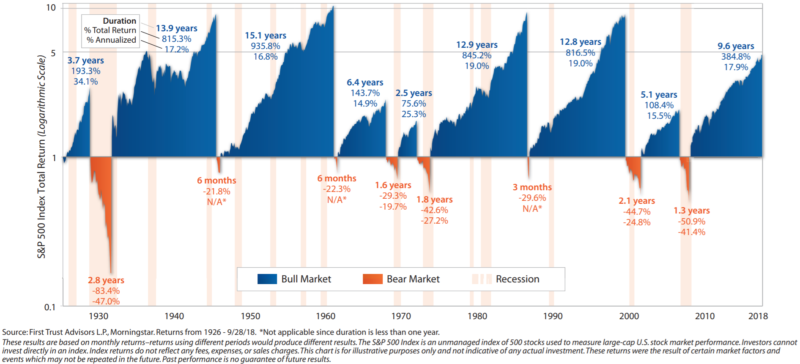

Historically, all bull markets end. How they end is interesting to me. The fact is that they end relatively quickly. Just look at this chart of market endings:

The lesson for me is that all the drops are quite sizable, ranging from -21.8% in six months to -83.4% in 2.8 years. The last major drop, 2008, the market dropped 44.7% over 1.3 years. Do you remember? I sure do.

Have You Buried Your Pain?

To be candid, we humans have very short memories when it comes to painful things. Most people I talk to have buried the panic, stress and upset they experienced in the 2008 crash and replaced it with euphoria of the last 10-year market run which the S&P grew (and is still growing) at a rate of about 18% per year compounding. That’s darn good and most everyone feels like an investing genius right now. The problem with euphoria is that it blocks reality. And, the reality is, you may be a genius today, but you may very well be kicking yourself tomorrow. I believe, for us money managers, and for you investors, right now a little humility will go a long way.

A Weed is a Weed is a Weed

Here’s the thing, seeing your investments grow is not a validation of how smart you are, nor how well you’ve planned for you future. Have you ever stepped back to consider that the portfolio you own, while growing, might be a weed in your beautiful garden? That’s right. Perhaps it’s a weed that looks and feels good, but it is a weed nevertheless.

How could your portfolio be a weed? Here are some things to consider:

- Do you have a specific growth goal for your portfolio?

Most portfolios I see are not designed to meet a specific growth goal, the one you need to succeed in your retirement (which means you probably don’t have a retirement financial plan). If not, you are probably taking more risk than you need to take. Weed this weed out. - Do you know how much you could lose when the market drops?

Rarely do I meet investors who know how much their portfolio will lose in a severe down market like 2008. All they know is that they have a conservative or moderately aggressive portfolio. The thing is, that some conservative portfolios, for example, will lose much more than others. The same goes for other portfolio risk labels. If you don’t know the loss potential in your portfolio you have a weed instead of a flower. Weed this out too. - You think you have a well-diversified portfolio, but you don’t.

Beauty is in the eye of the beholder. Everyone tells me their portfolio is diversified. Research shows, however, that if your portfolio is not well diversified across the 26 assets classes and the 8 product categories (includes market and insurance products), you are losing growth potential and taking more risk than necessary. Take a look at Vanguard’s study on what makes portfolios grow (Vanguard, “The Global Case for Strategic Asset Allocation (Wallick et al. 2012). If you do, you will see another weed that your portfolio may have that needs weeding.

Does Your Greed Outweigh Your Logic?

In a bull market, we don’t see the weeds because we are euphoric that our investments just keep doing well, especially if they’ve been doing so for a long time, like now, at the latter stages of the longest bull market in history. Although you know all bull markets come to an end, you think this one will just keep going, or you’ll be able to get out in time to protect yourself, or you’ll cross that bridge when you get to it. In other words, your greed to make more blinds your logic to protect against losses. That’s called stress. And if another 2008 repeats itself, just how stressed will you be?

Okay, How Do I Design My Parachute?

Let’s say you’re now convinced that waiting to the last minute to address the coming bear market is not a great idea. How do you design a parachute that will give you a soft landing, even if we have another 2008?

First things first. What does a parachute do? Well, if you jump out of an airplane it slows your descent and provides a soft landing. In investments, your parachute is anything that slows your losses and creates a worst-case scenario that you can live with. Investment parachutes come in different sizes and colors. Here’s a list of options:

- Diversification – I’ve said it before and I can’t say it enough, diversification rules. A well-diversified portfolio is a more efficient portfolio and will be a parachute within itself when the market drops.

- Non-Correlated Investments – These make up the fabric of your parachute and are the heart and soul of protecting your downside risk. There are many options that do not go down in value when the market declines:

- Cash – Always safe, but not earning anything, therefore losing value daily due to inflation.

- CD’s and Treasuries – Great downside protectors. But, despite rising interest rates, shorter term options won’t keep up with inflation.

- Fixed Interest Annuities – Works like a CD, but usually offers higher interest rates than CD’s. Plus, growth is tax-deferred pushing the real return higher.

- Fixed Index Annuities – Especially those focused on growth, which have higher caps, lower spreads and higher participation rates. These are designed to outpace inflation and, when the market declines, nothing is lost. A totally non-correlated asset, but one with higher growth potential than the others I’ve talked about so far.

- Investment Grade Bonds – Traditionally, bonds have always had an inverse relationship to the market. In other words, when the market falls, bond prices are supposed to rise. In 2008 and after, especially in the face of rising interest rates, bonds may not behave as expected and, instead, move with the market. While they should be part of your parachute, the latest research is suggesting that your parachute needs other components. Newer research is suggesting that a percentage of bonds be replaced with Fixed Index Annuities and the next category RCM.

- RCM – REITS (Real Estate Investment Trusts), Commodities, Managed Futures (Puts, Calls, Options) – More modern portfolios are substituting RCM for bonds as they typically have no correlation to the market at all. So, if the market drops, even though these are market-based products (as opposed to insurance-based products), your parachute will work fine.

Well, that’s a lot to take in, isn’t it? And it should be. Parachute building is a fine art. Think about it, would you jump out of plane if your parachute wasn’t tailored and created scientifically, and wasn’t proven to work 100% of the time? You want the best parachute possible. But how do you create yours?

I Wish I Could See the Future. But…

Most people, including me, have stress about uncertainty, not knowing what’s going to happen in the future, especially when it comes to money. I know, the more certainty I can build into my investments, as long as I am getting the return I need, the less stress I will have. You too, right? When it comes to building a portfolio, all of us are certain about two things:

- If your money is in a market-based product, there is a chance of losing.

- If your money is in a principal guaranteed product, there is virtually no risk of loss.

The question then is, when you build your portfolio, how much of each type of product – market-based (risk) or principal guaranteed based (safe) – should you have? Look at it this way. Suppose you lost 40% in 2008. If you haven’t made major changes in your portfolio, it is safe to assume that when the market tanks, it could lose 40% again. In other words, your parachute was not, and still may not, work well. Now, suppose you want a parachute that cushions your downside to losses of only 20%. That’s a simple decision – place 50% of your money in market-based products and 50% in principal guaranteed products. If you lose 40% in your market-based products, but zero in your principal guaranteed products, then your total portfolio has a loss of only 20%. That may be the kind of parachute you want for yourself.

It’s All About Balancing Risk, Growth and Stress

I understand what’s going through your mind right now. You are saying, “But Steve, I’m going to lose growth. Principal guaranteed products don’t have the same upside potential.” And that’s right. You see, you can’t have it both ways. The question is, which gives you less stress, greater peace of mind, but still reaches your goals? To answer that question, you need to know your goals, the growth and income levels needed, and build a plan or road-map to get you there. Instead of just buying stuff, you buy stuff only if it fits your plan. That’s how you create balance which, many say, is the secret to health, and a great life.

Is A Financial Plan in Your Future?

Is your portfolio feeling hodge-podged? Does it have a well-thought out parachute in its design? If your answer is first yes, and then no, it’s time to take a deep breath, put your hope or fantasy that the market will just keep going up on the back burner, and rebuild your portfolio. That means you make a complete financial plan, with income provisions, adjusted for inflation, and then, and only then, choose the investments that will get you there.