Retirement isn’t just about bidding farewell to your professional life; it’s about preparing for a new chapter that can span several decades. At the heart of your preparation is the development of retirement income planning.

But why is it so critical?

During your working years, your main source of income was a salary. During your retirement years, your sources of income will be Social Security, IRAs, pension plans, annuities, and other types of investments and personal savings plans.

A full understanding of your various retirement income streams should be part of your retirement plan. Projecting their future valuations is part of the planning process. You certainly do not want any surprises that undermine the quality of your life.

Also included in that plan should be a realistic accounting of the various expenses you will experience after you retire. Once all the numbers have been reviewed a realistic retirement income plan can be developed.

Many outside factors can affect your retirement income. Let’s start with inflation.

Your retirement assets look healthy in your early retirement years. But over long periods, remember you could live to be 100, inflation erodes the purchasing power of your assets. Imagine saving enough for a comfortable lifestyle today, only to find those funds are insufficient 10 or 20 years later. This is where the expertise of a retirement income planner becomes invaluable. This professional can help develop a retirement income plan that has offset the erosive impact of inflation.

Predicting your expenses in retirement requires some discipline. Many assume they’ll spend less in retirement, but travel, second homes, leisure activities, and unexpected healthcare costs can substantially impact these calculations. This part of your plan should be reviewed and updated annually – we want to minimize the surprises.

And therein lies the difference between retirement savings and retirement income. While savings is a lump sum accumulated over the years, retirement income is the flow of funds you withdraw each year to support your lifestyle and cover other expenses during your retirement years. Achieving a balance between money-in and money-out is vital for a long-term retirement plan.

Developing a steady income stream in retirement will require multiple strategies. This is where the importance of having a skilled retirement planner comes into play. This professional can craft a personalized plan that projects your income and expenses well into the future.

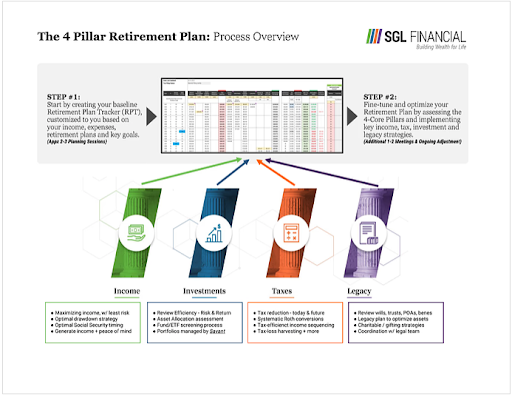

Why SGL Financial?

We start by creating your baseline Retirement Plan Tracker (RPT), then customize it based on your income, expenses, concerns, tolerance for risk, and key goals. For example, we look for ways to increase your retirement income without taking on substantial additional risk. We also assist in creating an optimized withdrawal strategy to fund your lifestyle. The planner’s role is to provide a disciplined process that produces peace of mind for the rest of your life.